Home Equity Loan Overview: How to Apply and Certify

Home Equity Loan Overview: How to Apply and Certify

Blog Article

Exploring the Advantages of an Equity Loan for Your Monetary Goals

Amidst the variety of economic devices offered, equity loans stand out for their prospective advantages in aiding people to reach their monetary goals. The benefits that equity financings use, varying from versatility in fund use to prospective tax benefits, offer a compelling instance for factor to consider.

Flexibility in Fund Usage

Adaptability in utilizing funds is a crucial advantage associated with equity financings, supplying consumers with versatile alternatives for handling their funds effectively. Equity financings enable individuals to access a line of credit history based on the equity they have developed up in their homes.

Additionally, the versatility in fund use prolongs to the amount borrowed, as consumers can normally access a big amount of money depending on the equity they have in their property. This can be especially advantageous for people looking to money significant costs or projects without considering high-interest alternatives. By leveraging the equity in their homes, consumers can access the funds they need while profiting from possibly lower rates of interest contrasted to various other kinds of borrowing.

Possibly Lower Rate Of Interest Rates

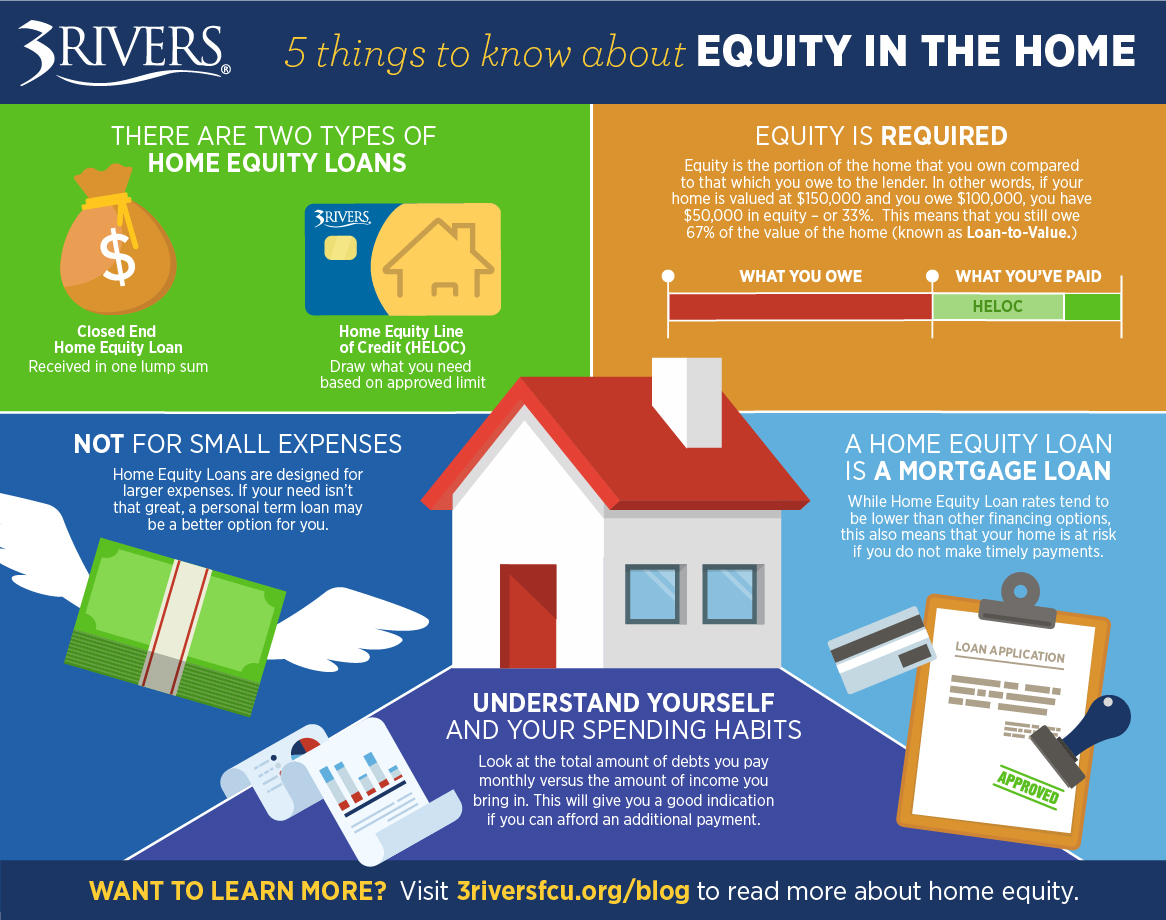

When thinking about equity loans, one may discover that they provide the possibility for lower rates of interest compared to different borrowing choices, making them an eye-catching financial selection for numerous individuals. This benefit stems from the reality that equity fundings are safeguarded by the customer's home equity, which minimizes the threat for loan providers. As a result of this decreased level of threat, loan providers are commonly ready to use lower rate of interest on equity fundings than on unsafe financings, such as personal car loans or credit history cards.

Reduced rates of interest can result in significant expense savings over the life of the funding. By securing a lower rates of interest with an equity car loan, consumers can potentially reduce their overall passion expenditures and lower their month-to-month repayments. This can maximize funds for other monetary goals or expenses, eventually boosting the customer's financial placement in the lengthy run.

Access to Larger Funding Amounts

Provided the capacity for lower rates of interest with equity lendings because of their protected nature, customers may also gain from access to larger funding quantities based upon their offered home equity. This accessibility to larger car loan amounts can be advantageous for people aiming to money considerable financial objectives or tasks (Home Equity Loans). Whether it's for home remodellings, debt loan consolidation, education costs, or various other substantial investments, the ability to borrow even more money via an equity finance supplies borrowers with the economic flexibility needed to achieve their purposes

Potential Tax Advantages

Securing an equity loan may use possible tax obligation advantages for consumers seeking to maximize their financial advantages. One considerable benefit is the potential tax deductibility of the rate of interest paid on the equity financing. In a lot of cases, the passion on an equity car loan can be tax-deductible, similar to home loan passion, under particular conditions. This tax deduction can lead to reduced overall loaning costs, making an equity loan a much more monetarily eye-catching alternative for those qualified to declare this advantage.

Additionally, using an equity lending for home enhancements might also have tax benefits. By using the funds to remodel or enhance a second or key house, homeowners may increase the residential property's worth. This can be helpful when it comes time to market the building, possibly minimizing capital gains taxes or perhaps certifying for certain exclusion thresholds.

It is crucial for consumers to speak with a tax obligation specialist to completely understand the specific tax ramifications and benefits connected to equity lendings in their specific circumstances. Alpine Credits Equity Loans.

Faster Approval Process

Conclusion

In summary, an equity lending provides flexibility in fund use, potentially lower rate of interest, accessibility to bigger loan quantities, prospective tax obligation benefits, and a much faster approval procedure. These advantages make equity lendings a viable option for people aiming to achieve their economic goals (Alpine Credits Home Equity Loans). It is very important to very carefully take into consideration the terms of an equity finance prior to choosing to ensure it aligns with your details financial requirements and purposes

:max_bytes(150000):strip_icc()/home-equity-loans-315556_final3-23fa1237c577475f811fe9fc06eedec2.png)

Provided the possibility for reduced interest rates with equity car loans due to their safeguarded nature, customers may likewise benefit from click here for more access to larger lending quantities based on their available home equity (Equity Loan). In contrast, equity fundings, leveraging the equity in your home, can supply a quicker approval process because the equity offers as security, reducing the risk for lending institutions. By picking an equity financing, borrowers can expedite the lending approval procedure and accessibility the funds they require without delay, giving a beneficial monetary remedy throughout times of necessity

Report this page